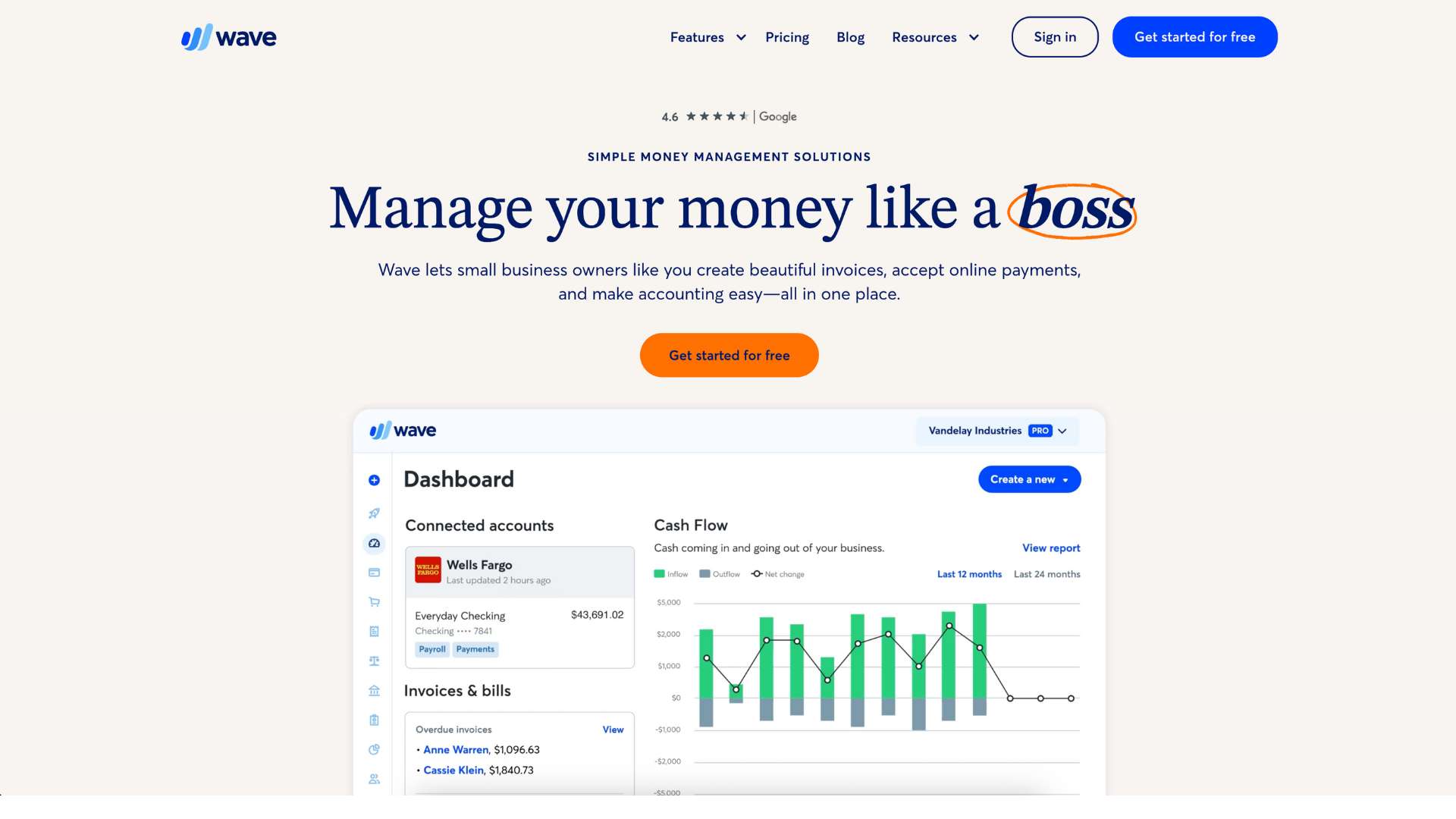

Wave Accounting Review: Features, Pricing, Pros & Cons

Wave Accounting is a free, cloud-based accounting software tailored for small businesses, freelancers, and solopreneurs. It brings together bookkeeping, invoicing, receipt scanning, and payments in one streamlined platform, at no cost for its core features.

Designed with simplicity in mind, Wave enables non-accountants to manage their finances confidently and professionally.

The core problem Wave solves is the complexity and cost of traditional accounting software. Most small business owners and freelancers don’t have the time or budget to handle complicated systems or hire full-time accountants.

Wave steps in to bridge that gap, offering intuitive tools that automate and simplify financial management.

This platform is ideal for solo entrepreneurs, creative freelancers, consultants, and microbusinesses. If your needs center around managing income, expenses, and client payments efficiently without investing in costly software, Wave is built for you.

About the Company

Wave Financial Inc. was founded in 2010 by Kirk Simpson and James Lochrie in Toronto, Canada. The vision was clear from the start: build powerful yet easy-to-use financial tools for entrepreneurs and small business owners. The idea took off quickly, thanks to their free model and clean interface.

In 2019, Wave was acquired by H&R Block, a U.S. tax preparation company, which expanded Wave’s reach and fortified its infrastructure. Today, the platform serves millions of users worldwide, offering essential accounting features and optional paid services like payroll and payments.

Website: https://www.waveapps.com

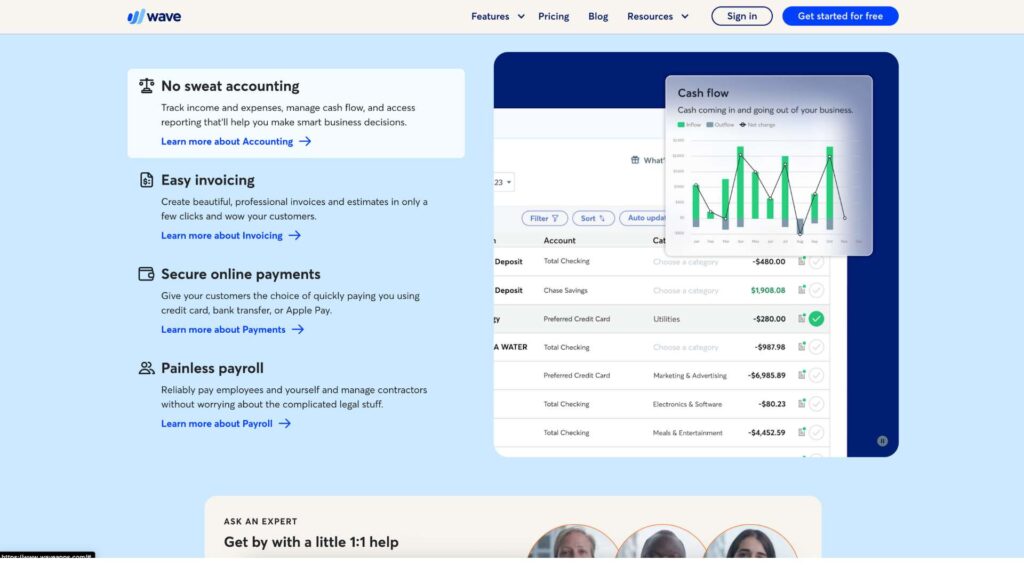

Key Features

Wave groups together core financial functionalities in an accessible way. Here’s a breakdown of its major tools:

Accounting & Bookkeeping

- Double-entry accounting: Tracks debits and credits for accurate, GAAP-compliant bookkeeping.

- Bank connection: Automatically imports transactions and categorizes them.

- Reconciliations: Helps users ensure that books match their bank data.

- General ledger and journal entries: Allows manual entries and adjustments.

- Cash flow tracking: Real-time views of incoming and outgoing money.

Invoicing & Billing

- Custom invoice templates: Add logos, colors, and personalized messages.

- Recurring billing: Automate invoices for repeat clients.

- Payment reminders: Send automatic reminders for unpaid invoices.

- Status tracking: See which invoices are viewed, paid, or overdue.

Payments

- Wave Payments integration: Accept credit cards and bank payments online.

- Automatic reconciliation: Payments are automatically synced with accounting records.

- Transaction fees: 2.9% + $0.60 per credit card transaction, 1% for ACH.

Receipt Scanning

- Mobile capture: Snap and upload receipts via smartphone.

- Automatic entry: Wave matches receipts with corresponding expenses.

- Cloud sync: Scanned data is stored in the cloud and accessible on the dashboard.

Payroll (U.S. Only)

- Full-service payroll: Available in 14 U.S. states, includes tax filings and W2/1099 generation.

- Self-service payroll: Available in all other U.S. states without tax filings.

- Direct deposit: Pays employees and contractors directly.

- Employee portal: Employees can view pay stubs and tax documents.

Reports & Statements

- Balance Sheet, Profit & Loss, Cash Flow Statement

- Sales tax summary

- Custom filters and exports: Great for accountants and tax preparers.

Integrations

- Google Sheets, Zapier: Automate workflows and export data.

- PayPal, Etsy, Shopify: Supported via third-party apps or integrations.

- Native integration support is limited compared to premium platforms.

Security

- 256-bit SSL encryption: Ensures secure data transmission.

- Bank-level security: Read-only data access and regular audits.

- Data backups: Cloud-based, with frequent redundancy.

User Interface and Experience (UI/UX)

Wave offers one of the cleanest, easiest-to-navigate interfaces in the accounting space. Its dashboard is organized into a sidebar format, where users can jump between Sales, Purchases, Accounting, Banking, Payroll, and Reports. Color-coded summaries make it easy to monitor cash flow and outstanding invoices.

Onboarding is intuitive, with helpful prompts guiding users to set up accounts, link banks, and create their first invoices. New users are often up and running in under 30 minutes.

Wave is web-based, but it offers two mobile apps:

- Wave Invoicing: Create and manage invoices on the go.

- Wave Receipts: Snap receipts and sync them to your account.

While not as robust as some desktop applications, Wave’s mobile experience is excellent for freelancers who work remotely or travel often.

Platforms Supported

| Platform | Supported | Notes |

|---|---|---|

| Web Browser | ✅ | Main platform; full functionality |

| Android | ✅ | Invoicing and receipt apps |

| iOS | ✅ | Invoicing and receipt apps |

| Windows/macOS | ❌ | No native desktop version |

| Offline Access | ❌ | Cloud-only; internet required |

Wave is entirely cloud-based, which means you can access your data from any internet-connected device. However, it lacks offline functionality—something to keep in mind if you often work in low-connectivity areas.

Pricing

Wave stands out for offering core tools for free. Its pricing structure revolves around pay-as-you-go add-ons.

| Plan | Price | Features Included | Best For |

|---|---|---|---|

| Accounting & Invoicing | Free | Unlimited invoices, accounting, receipt scanning | Freelancers & small businesses |

| Wave Payments | Pay-per-use | 2.9% + 60¢ credit card, 1% ACH | Businesses accepting payments |

| Payroll | From $20/mo | Tax filing (in some states), direct deposit, W2s | U.S.-based employers |

| Bookkeeping Services | From $149/mo | Monthly support and coaching from pros | Businesses needing experts |

- Free Trial: Not needed for the free plan

- Hidden Fees: None for core services

- Cancellation Fee: None

Wave’s pricing model is ideal for solopreneurs on a budget. You pay only if you need payroll or payment processing.

Pros and Cons

Pros

- Truly free accounting: No freemium tricks—core services are free.

- Beginner-friendly UX: Even first-timers can navigate it easily.

- Mobile tools included: Receipt scanning and invoicing on mobile.

- Solid reporting: Enough detail for taxes and general financial health.

Cons

- Limited scalability: Not built for complex or multi-user environments.

- U.S.-only payroll: Not available outside the U.S.

- Few native integrations: Less plug-and-play than QuickBooks or Xero.

- No inventory management: May be limiting for product-based businesses.

Customer Support and Resources

Wave’s free model limits its live support availability, but they offer strong resources for self-service.

- Live Chat: Paid users only (e.g., Payroll, Advisor Services)

- Email Support: Available for all users

- Help Center: Well-written, with step-by-step tutorials

- Video Library: Explains setup, features, and best practices

- Community Forum: Active and moderated by Wave staff

- Wave Advisors: Optional paid support from accounting professionals

The knowledge base is one of the best among free tools, but users on the free plan won’t get real-time help.

Real-World Use Cases / Ideal Users

Wave is purpose-built for small-scale professionals and entrepreneurs:

- Freelancers: Easily manage invoices, track payments, and file taxes. Wave eliminates the need for spreadsheets.

- Consultants & Coaches: Create recurring invoices, accept payments, and use reports to review income trends.

- Small Business Owners (US): Add payroll and bookkeeping support as you grow without switching platforms.

- Online sellers: Manage transactions from Shopify or Etsy through accounting exports and integrations.

Its no-cost model makes it particularly attractive for those who are just starting out or looking to minimize monthly expenses.

User Reviews and Ratings

Wave receives strong marks across major review platforms.

| Platform | Rating (2025) | Summary |

|---|---|---|

| G2 | 4.2/5 | Easy setup and clean interface praised |

| Capterra | 4.4/5 | Users love invoice design and price |

| Trustpilot | 3.9/5 | Mixed feedback on customer support |

User Quote:

“I’ve used Wave for three years and haven’t paid a cent for accounting. It does exactly what I need and nothing more. Perfect for freelancers.”

— Jason M., Capterra

Best Alternatives

If Wave doesn’t fit your growing needs, here are some strong competitors:

| Alternative | Best For | Comparison |

|---|---|---|

| QuickBooks Online | Larger businesses & accounting firms | More powerful, but paid and steeper learning curve |

| FreshBooks | Service professionals with time tracking | Great UX, recurring billing, but more expensive |

| Zoho Books | Automation seekers | More features for free on starter plans |

| Xero | Businesses needing inventory & payroll | Better for teams and global use |

| Bonsai | Freelancers with contracts + CRM | Adds proposals, contracts, and client portal |

Summary

Wave Accounting remains one of the best free accounting platforms in 2025 for freelancers and small businesses. It brings essential bookkeeping, invoicing, and receipt management tools into one easy-to-use interface, all without monthly fees.

With add-ons for payments, payroll, and advisory services, users can scale gradually if needed.

Still, it may fall short for users needing deep integrations, team collaboration, or advanced inventory tools. But for solopreneurs and self-employed professionals, it’s a simple, powerful, and cost-effective solution.

Try it for free at waveapps.com, or explore more software reviews and comparisons on usefully.site.

Media

How To Use Wave Accounting Software 2025 (Tutorial For Beginners)

How To Use Wave Accounting Software for Beginners (2025)

Wave Accounting Review 2025 | Pros & Cons (NOT SPONSORED)