Sage Business Cloud Accounting Review: Features, Pricing, Pros & Cons

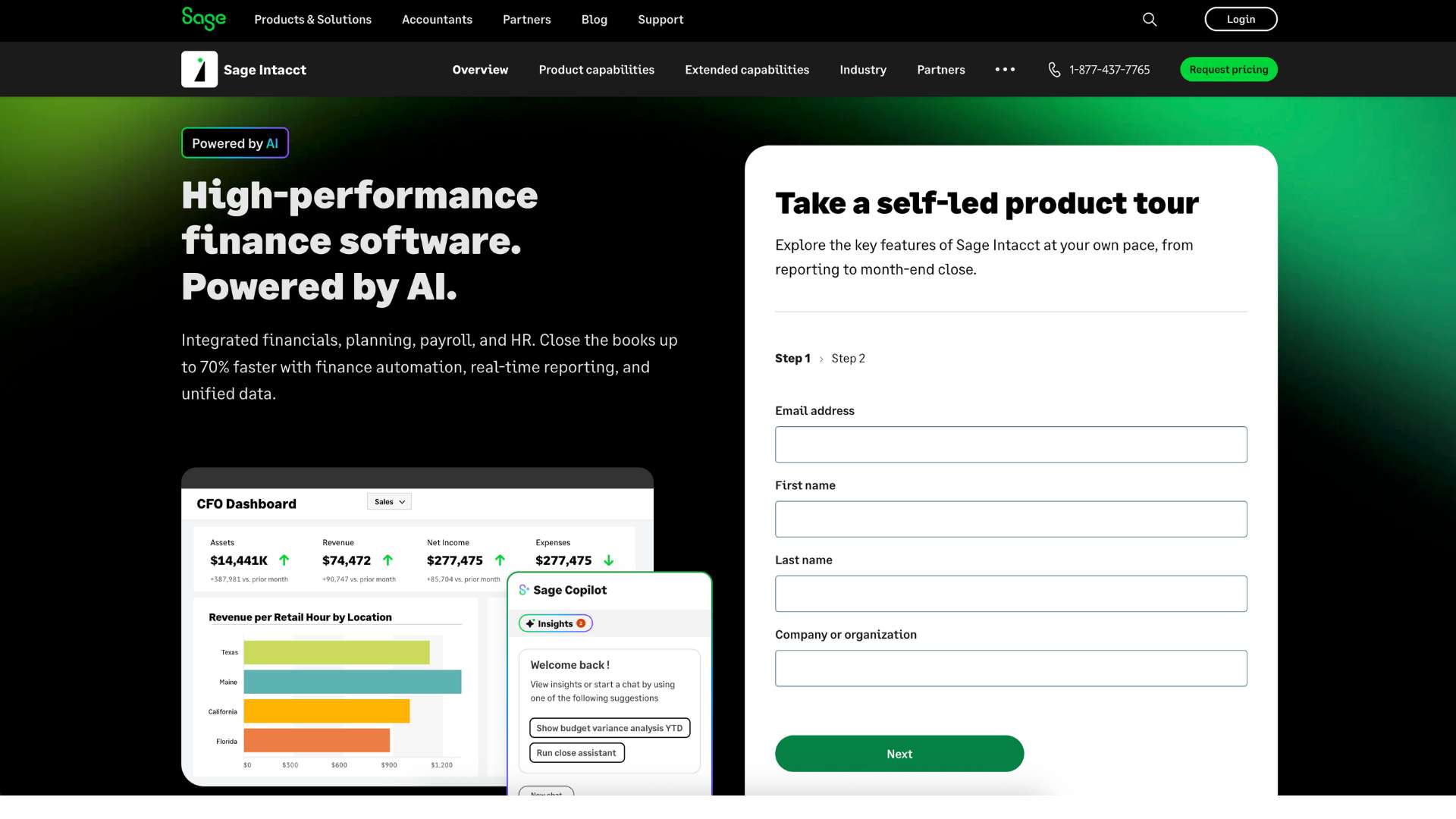

Sage Business Cloud Accounting is a cloud-based financial management software designed to simplify the accounting process for small businesses, freelancers, and accountants. It empowers users to create invoices, track expenses, manage cash flow, and generate compliant financial reports — all within a sleek, easy-to-use online platform.

Many small business owners struggle to stay on top of their finances. From overdue invoices to last-minute tax preparation and bank reconciliation, these tasks can quickly eat into valuable working hours. Sage solves this problem with automation, real-time reporting, and collaboration tools that make accounting easier and faster.

The software is ideal for entrepreneurs, consultants, service-based professionals, and even small teams who want a secure, professional solution without the need for a full-time bookkeeper or expensive enterprise systems.

Company Background

Sage Business Cloud Accounting is developed by Sage Group plc, a UK-based multinational enterprise software company. Founded in 1981 by David Goldman, Paul Muller, and Graham Wylie in Newcastle upon Tyne, Sage started as a solution for printing payroll checks and grew into one of the world’s most trusted names in accounting software.

Sage originally became popular for its desktop products like Sage 50 and evolved over the years to offer a fully cloud-based platform tailored to the needs of modern businesses. Today, Sage serves millions of customers globally, with strong footholds in the UK, US, Canada, South Africa, and beyond.

- Founders: David Goldman, Graham Wylie

- Founded: 1981

- Headquarters: Newcastle upon Tyne, UK

- Website: https://www.sage.com/en-us/sage-business-cloud/intacct/

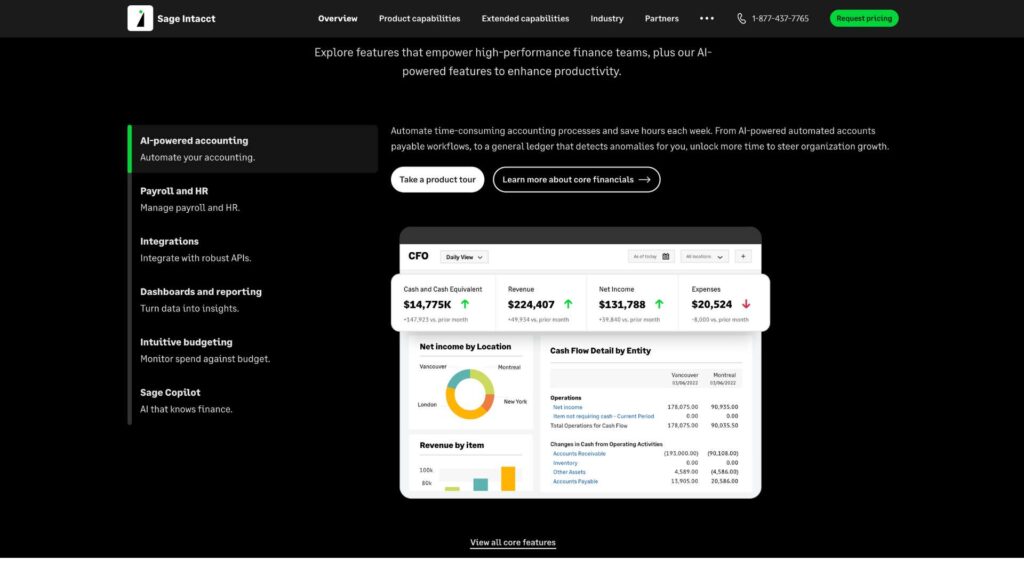

Key Features

Invoicing & Billing

- Custom Invoices: Create polished, branded invoices with multiple currency support.

- Recurring Billing: Set up automatic recurring invoices for long-term clients.

- Payment Tracking: See when invoices are viewed and paid.

Expense & Reconciliation

- Bank Feeds: Automatically pull in transactions from your bank.

- Receipt Capture: Upload photos of receipts directly via the mobile app.

- Smart Reconciliation: Match transactions in seconds and reduce manual work.

Cash Flow & Forecasting

- Cash Flow Dashboards: View inflows, outflows, and forecasts in real-time.

- Budgeting Tools: Track against budgets to stay in control of your finances.

- Notifications: Get alerts for overdue invoices and low balances.

Reporting & Compliance

- Built-In Reports: Access profit & loss, balance sheet, VAT reports, and more.

- Audit Trail: Secure recordkeeping for financial accuracy.

- Tax Tools: Localized tax tools (e.g., HMRC for UK, GST for others).

Inventory Management

- Simple Stock Tracking: Monitor product levels, costs, and sales trends.

- Product Categories: Group and organize services and inventory items.

Collaboration & Multi-User Access

- Role Permissions: Invite your team or accountant with controlled access.

- Accountant View: Dedicated tools for advisors and bookkeepers.

Integration & Automation

- Popular Integrations: Connects with PayPal, Stripe, AutoEntry, Office 365.

- APIs: For developers who want custom workflows or apps.

- Automation Rules: Set up recurring entries and automated notifications.

Mobile App

- Mobile Invoicing: Create and send invoices from your phone.

- Real-Time Sync: Data syncs instantly with your web account.

- Available on Android and iOS

User Interface and Experience (UI/UX)

Sage Business Cloud Accounting stands out for its clean, professional design that balances simplicity and functionality. The main dashboard displays cash flow graphs, overdue invoices, and profit summaries at a glance.

The interface is extremely user-friendly, particularly for non-accountants. The onboarding experience is intuitive, with step-by-step guidance, helpful tooltips, and embedded tutorials that walk users through essential setup tasks like connecting a bank, adding products, and creating their first invoice.

Both mobile and desktop experiences are polished. The mobile app mirrors the web version well and allows users to invoice, capture receipts, and check balances on the go. Accessibility features like keyboard shortcuts and screen reader compatibility are also available for improved usability.

Platforms Supported

| Platform | Available |

|---|---|

| Web (Browser) | ✅ Yes (Cloud-based) |

| Windows/macOS | ✅ Yes (via browser) |

| Android | ✅ Yes (Mobile App) |

| iOS | ✅ Yes (Mobile App) |

| Offline Access | ❌ Not Available |

Sage Business Cloud Accounting is entirely cloud-based. All data is stored securely in the cloud, and real-time sync ensures users can access up-to-date information from any device.

Pricing

| Plan | Price | Features Included |

|---|---|---|

| Start | $10/month | Basic invoicing, bank reconciliation, expense tracking |

| Standard | $25/month | Quotes, cash flow forecasts, multiple users, full reporting |

| Payroll Add-On | Custom Pricing | Available in select regions (e.g., UK, US), adds payroll and filings |

| Free Trial | 30 Days | Access to Standard features, no credit card required |

Sage often offers limited-time discounts such as 50% off for the first 3–6 months. The Start plan is best suited for freelancers and solo entrepreneurs, while Standard suits small businesses with multiple users and more complex needs.

Pros and Cons

Pros

- Easy to use: No accounting background needed

- Powerful mobile features: Full invoicing, expense capture, and reporting on mobile

- Excellent support for collaboration: Easily invite and work with accountants

- Reliable and secure: Sage’s long-standing reputation for compliance and security

Cons

- Limited offline access: Entirely cloud-dependent

- Basic inventory features: Not ideal for businesses with complex stock needs

- Customization: Limited control over report formatting and invoice templates

Customer Support and Resources

| Support Type | Availability |

|---|---|

| Live Chat | ✅ Business hours |

| ✅ 24–48 hour reply | |

| Phone Support | ✅ (Paid plans only) |

| Help Center | ✅ Rich knowledge base |

| Webinars & Tutorials | ✅ Regularly updated |

| Community Forum | ✅ Active, helpful |

Sage provides a helpful support ecosystem, including a searchable help center, video tutorials, and an active community forum where users share tips and troubleshoot issues. Premium support is included in higher-tier plans.

Real-World Use Cases / Ideal Users

- Small Businesses:

Retail shops, agencies, and service providers use Sage to stay compliant and organized without needing a full-time accountant. - Freelancers and Solopreneurs:

Perfect for consultants and creative professionals managing multiple clients. Track billable hours, send recurring invoices, and see how much you’re earning in real-time. - Nonprofits and NGOs:

Use Sage for donor tracking, basic fund accounting, and transparent reporting that satisfies compliance needs. - Accountants and Bookkeepers:

Manage multiple client accounts under one login, simplify VAT returns, and securely collaborate with clients.

User Reviews and Ratings

| Platform | Rating (Out of 5) | Highlights |

|---|---|---|

| G2 | 4.2 | “Simple yet powerful for small business.” |

| Capterra | 4.1 | “Best cash flow dashboard I’ve used.” |

| Trustpilot | 3.9 | “Could improve support but solid tool.” |

| Software Advice | 4.0 | “Very reliable for client accounting.” |

Customer Quote:

“With Sage, I know exactly where my money is going, and my accountant loves how easy it is to access the reports.” – James L., Business Owner

Best Alternatives

| Alternative | Best For | Key Difference |

|---|---|---|

| QuickBooks Online | Larger teams and integrations | More features but higher cost |

| Xero | Accountant collaboration and inventory | Stronger reporting and multi-currency support |

| Zoho Books | Budget-conscious small businesses | Integrates with Zoho suite and is automation-rich |

| Wave Accounting | Freelancers and solo startups | Free version available but fewer features |

| FreshBooks | Service-based professionals | Time tracking and client portal functionality |

Summary

Sage Business Cloud Accounting delivers a dependable and user-friendly experience for small businesses looking to stay organized and tax-compliant. Its core strengths lie in intuitive design, cash flow visibility, and strong mobile capabilities.

While it may not match QuickBooks or Xero in feature depth, it remains a highly capable solution for solo entrepreneurs and small teams.

If you’re seeking a straightforward accounting tool with cloud access, excellent invoicing, and collaboration features — and you don’t need enterprise-level customization — Sage Business Cloud Accounting is worth a 30-day trial.

Ready to explore more tools like this? Browse our full list of accounting software reviews on usefully.site.

Media

Sage Accounting Tutorial How To Use Sage Accounting – 2025 | For Beginners

Sage Accounting Tutorial for Beginners 2025 | Full Guide

Sage Accounting Tutorial for Beginners (2025) | How to Use Sage Accounting (Step By Step)

YVpngakIdazqGmprnOQPoX