Xero Review: Features, Pricing, Pros & Cons for Small Business Accounting

Xero is one of the most widely recognized cloud-based accounting platforms, designed to help small businesses, freelancers, and accountants simplify their financial management.

From handling invoices and reconciling bank transactions to managing projects and collaborating with accountants, Xero offers a full suite of tools for modern business operations.

Managing finances can be overwhelming for small business owners. Manual spreadsheets, paper receipts, and slow bank reconciliation processes lead to stress and missed opportunities.

Xero solves these issues by offering a streamlined, cloud-first approach to accounting that automates many tedious tasks and keeps everything organized and accessible in one place.

The software is tailored for entrepreneurs, sole proprietors, bookkeepers, and even growing teams who want reliable, user-friendly, and scalable accounting solutions.

Company Background

Xero was founded in 2006 in Wellington, New Zealand, by tech entrepreneur Rod Drury and chartered accountant Hamish Edwards. What began as a small regional software firm quickly grew into a global leader in cloud-based accounting.

Now headquartered in Wellington with satellite offices in Australia, the United States, the UK, and Singapore, Xero has over 3.95 million subscribers worldwide as of 2025. It’s publicly traded on the Australian Securities Exchange (ASX: XRO) and continues to expand its ecosystem of features and integrations.

The company’s story is rooted in innovation—Drury saw the inefficiencies of desktop accounting and sought to create a better way using cloud technology. That vision helped Xero disrupt an industry long dominated by legacy software.

Official Website: https://www.xero.com/us

Key Features

Xero’s strength lies in its well-rounded, modular functionality. Here’s how its key features break down:

Core Accounting

- Bank Reconciliation: Connect your bank, credit card, and PayPal accounts to automatically import and match transactions.

- Cash Flow Tracking: Visual dashboards display your daily financial position and forecasted cash flow.

- General Ledger: Fully compliant double-entry accounting with live data updates.

Invoicing and Payments

- Custom Invoices: Design branded invoices with your logo and layout preferences.

- Recurring Invoices: Automate billing for subscription-based services or regular clients.

- Online Payments: Accept payments via Stripe, PayPal, and GoCardless directly from invoices.

Expense Management

- Mobile Receipts: Snap and upload receipts using the mobile app.

- Employee Reimbursements: Submit, track, and approve expenses across teams.

- Multi-Currency Support: Great for international purchases and vendors.

Payroll (U.S. via Gusto)

- Integrated Payroll: Seamlessly syncs payroll data from Gusto.

- Tax Filing: Automate tax calculations and filings.

- Direct Deposit: Schedule employee payments with ease.

Inventory and Projects

- Inventory Tracking: Manage product levels, costs, and availability.

- Project Accounting: Assign costs, track time, and monitor project profitability.

Reports and Analytics

- Pre-Built Reports: Includes profit & loss, balance sheets, and tax summaries.

- Custom Reports: Design custom financial reports with filters and formulas.

- Budgeting Tools: Compare budgets to actuals and track financial goals.

Collaboration

- Unlimited Users: Unlike many competitors, Xero includes unlimited users in all plans.

- Permissions Control: Assign specific access levels (e.g., invoicing only, view-only).

- Advisor Portal: Accountants can log in to manage multiple client accounts from one dashboard.

Integrations

- App Ecosystem: Over 1,000 integrations including Shopify, Square, Zapier, HubSpot, Gusto, and more.

- API Access: Developers can build custom integrations for unique workflows.

Mobile App

- Functionality: Create invoices, reconcile transactions, and manage receipts from your phone.

- Notifications: Get alerts for overdue invoices or bank transactions.

Security

- Encryption: End-to-end encryption protects sensitive financial data.

- 2FA: Two-factor authentication for added security.

- Audit Logs: Track all user activity for compliance and accountability.

User Interface and Experience (UI/UX)

Xero’s design is one of the most polished in the accounting space. The dashboard is clean and modern, presenting a snapshot of your cash flow, pending invoices, and recent transactions.

The onboarding process is friendly, guided by tutorials, setup checklists, and optional data imports from QuickBooks or spreadsheets.

Its mobile apps for Android and iOS mirror most desktop features, allowing users to run their business on the go.

Accessibility is also commendable, with keyboard navigation, screen reader support, and high-contrast modes for users with vision impairments.

Platforms Supported

| Platform | Available? |

|---|---|

| Web Browser | Yes |

| Windows/macOS | Via browser |

| Android | Yes (App Store) |

| iOS | Yes (App Store) |

| Offline Access | Limited |

As a cloud-first tool, Xero primarily requires an internet connection but does allow some mobile access to cached data.

Pricing

Xero offers three primary pricing tiers in 2025, each designed for a different stage of business growth.

| Plan | Monthly Cost | Best For | Key Features |

|---|---|---|---|

| Early | $15 | Freelancers, Startups | 20 invoices, 5 bills, reconciliation, mobile app |

| Growing | $42 | Small Businesses | Unlimited invoices/bills, bank rules, bulk reconciling |

| Established | $78 | Larger SMBs & Agencies | Multi-currency, project tracking, expense claims |

- Free Trial: 30 days with full access

- Add-ons: Payroll via Gusto (paid separately), additional apps via the marketplace

Pros and Cons

Pros

- Extremely user-friendly interface and mobile app

- Unlimited users in all plans

- Over 1,000 integrations with third-party apps

- Strong accounting collaboration tools

- Scalable from freelance to small enterprise

Cons

- Payroll is outsourced (not native in U.S.)

- Offline functionality is limited

- Pricier than some competitors as you scale

- Advanced features gated behind the top-tier plan

Customer Support and Resources

Xero offers several support and learning resources:

- Channels:

- 24/7 email ticketing

- In-app chatbot with escalation

- No phone support for regular users

- Learning Resources:

- Xero Central: A vast knowledge base

- Webinars and training videos

- Certification courses for accountants and advisors

- Community:

- Xero Discussions forums

- Partner programs and advisor support groups

Support quality is rated highly for documentation, though some users note the lack of phone support as a downside.

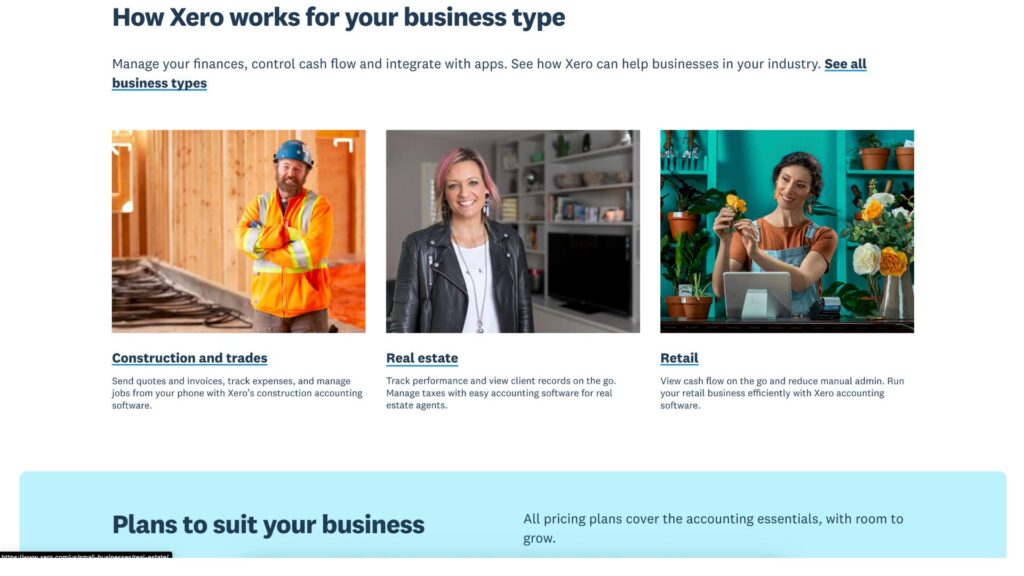

Real-World Use Cases / Ideal Users

- Freelancers & Consultants

Xero helps solopreneurs send professional invoices, get paid faster, and stay on top of taxes with minimal effort. - Small Business Owners

Retail shops, agencies, and local service providers use Xero to automate their books, integrate sales data, and gain full cash flow visibility. - Accountants & Bookkeepers

Manage multiple clients, reconcile accounts faster, and produce custom reports—all from a single advisor portal. - E-commerce Stores

Shopify and Amazon sellers can automate the flow of orders, payments, and tax calculation directly into their accounting dashboard.

User Reviews and Ratings

| Platform | Rating (out of 5) | Notable Highlights |

|---|---|---|

| G2 | 4.3/5 | Easy invoicing, bank syncing, automation |

| Capterra | 4.4/5 | Praised for UX, small business focus |

| Trustpilot | 3.7/5 | Mixed support reviews, strong feature feedback |

| Software Advice | 4.5/5 | Good for consultants and international users |

“Xero transformed how we manage our books. It’s like having a mini-finance team in one app.”

– Elena M., Marketing Agency Owner (G2 Review)

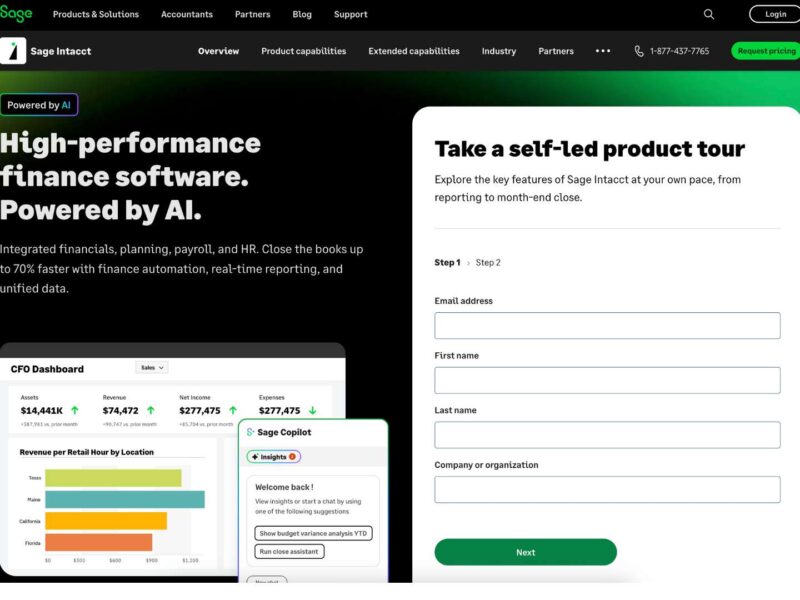

Best Alternatives

| Tool | Best For | Key Differences |

|---|---|---|

| QuickBooks Online | U.S. market, native payroll | Stronger market presence, built-in payroll |

| FreshBooks | Service-based freelancers | Superior time tracking, easier UI |

| Zoho Books | Budget-conscious users | Cheaper plans, integrates well with Zoho suite |

| Wave Accounting | Beginners needing free tools | 100% free, but fewer features and no support |

| Sage Business Cloud | Enterprise-level accounting | Robust reporting, not as user-friendly |

Summary

Xero stands out in 2025 as a top-tier cloud-based accounting software, purpose-built for modern businesses. It blends a clean, intuitive interface with powerful automation, real-time data syncing, and an expansive ecosystem of third-party integrations.

While it may not be the cheapest option and lacks native payroll in the U.S., its core value shines through in its ease of use, mobile support, and collaborative tools for accountants and business owners alike.

Try Xero if you want an accounting solution that’s as smart and scalable as your business.

Visit xero.com to start your free trial or browse other reviews on usefully.site to find the perfect tool for your needs.

Media

How to use XERO (2025)

Xero Tutorial 2025 | Learn Bookkeeping with Xero in 15 Minutes

How to Use Xero Projects in 2025! Simple Guide