QuickBooks Online Review: Features, Pricing, Pros & Cons for Modern Businesses

QuickBooks Online is a cloud-based accounting software designed to help small businesses, freelancers, and accountants manage their finances with ease.

As one of the most recognized names in the accounting industry, QuickBooks Online transforms tedious financial tasks into automated workflows, making it easier to stay on top of cash flow, invoicing, expenses, and tax compliance.

In 2025, the pressure to keep accurate, real-time financial data is higher than ever, especially for entrepreneurs navigating hybrid work setups, e-commerce growth, and compliance regulations. QuickBooks Online addresses these needs by offering an all-in-one platform accessible anytime, anywhere.

This review will break down everything you need to know—from the software’s standout features and pricing to real-world use cases, platform support, and the pros and cons to help you decide if QuickBooks Online is right for your business.

About the Company

Intuit Inc. is the powerhouse behind QuickBooks, founded in 1983 by Scott Cook and Tom Proulx. Based in Mountain View, California, Intuit began as a desktop personal finance solution and has evolved into a global fintech giant.

The company also owns TurboTax, Mint, Mailchimp, and Credit Karma, making it one of the most influential software providers in personal and business finance.

QuickBooks Online was introduced in 2001 to bring the bookkeeping power of the original QuickBooks to the cloud. Since then, it has grown into a SaaS accounting platform used by millions of small businesses worldwide, supporting everything from payroll to predictive cash flow analytics.

Website: quickbooks.intuit.com

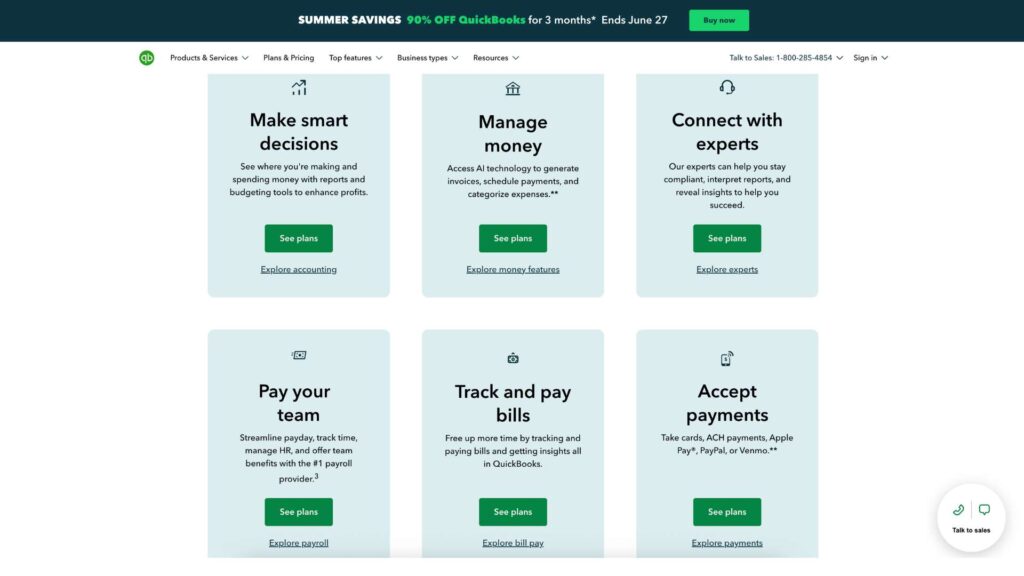

Key Features of QuickBooks Online

QuickBooks Online is packed with essential tools designed to automate accounting workflows. Here’s a closer look:

Accounting & Bookkeeping

- Chart of Accounts: Customize accounts to track assets, liabilities, equity, income, and expenses.

- General Ledger & Journal Entries: Maintain audit trails and double-entry records.

- Real-time Financial Reports: Instantly generate balance sheets, profit & loss, and cash flow statements.

Invoicing & Payments

- Branded Invoices: Create professional invoices with logos and custom colors.

- Recurring Invoices: Set up automatic billing for clients.

- Online Payments: Accept payments via credit card, ACH, PayPal, and Venmo.

Expense & Mileage Tracking

- Auto-categorization: Expenses imported from bank feeds are auto-tagged by AI.

- Receipt Scanning: Snap and attach receipts using the mobile app.

- Mileage Log: GPS-enabled tracking for reimbursements and deductions.

Banking & Reconciliation

- Bank Feeds: Automatically sync transactions from over 20,000 financial institutions.

- Smart Matching: Match deposits and expenses to bank statements.

- Rules Engine: Set custom rules to categorize recurring transactions.

Payroll (Add-on)

- Automated Payroll: Run payroll, file taxes, and generate paystubs.

- Employee Access: Staff can view their W-2s and update info.

- Contractor Payments: Issue 1099s and schedule payments.

Reporting & Insights

- 50+ Reports: Customizable templates for sales, expenses, inventory, etc.

- Business Snapshot: Dashboard widgets display KPIs and cash flow trends.

- Forecasting: AI-powered future cash flow projections.

Integrations & App Ecosystem

- Top Integrations: Shopify, PayPal, Square, HubSpot, Gusto

- Zapier Support: Automate data flows between 1,000+ apps.

- Marketplace: Extend functionality with industry-specific add-ons.

AI & Automation

- Auto-Categorization: Learns and suggests proper labels for expenses.

- Reminders & Follow-ups: Alerts for unpaid invoices and bills.

- Cash Flow Prediction: AI forecasts future inflows and outflows.

Security & Compliance

- Data Encryption: 256-bit SSL protection and multi-factor authentication.

- Regulatory Compliance: Supports GDPR and HIPAA-like controls.

- User Roles: Limit access by employee or accountant roles.

User Interface and Experience (UI/UX)

QuickBooks Online offers a clean, modern interface that prioritizes ease of use:

- Dashboard: Includes key metrics like income, expenses, profit trends, and tasks.

- Navigation: Left sidebar menu makes jumping between modules seamless.

- Onboarding: New users are guided through a step-by-step wizard and resource center.

- Mobile App: Excellent for invoicing, mileage tracking, and receipt capture on the go.

- Accessibility: High-contrast mode, screen reader support, and keyboard shortcuts available.

Even non-accountants can navigate it easily, though deeper features like journal entries and reconciliations may require a bit of a learning curve.

Platforms Supported

| Platform | Supported? | Notes |

|---|---|---|

| Web App | ✅ Yes | Works in all major browsers |

| Windows/macOS | ✅ Yes (via browser) | No dedicated desktop app needed |

| iOS App | ✅ Yes | Full-featured QuickBooks Mobile app |

| Android App | ✅ Yes | Same as iOS version |

| Offline Access | ⚠️ Limited | Only some mobile functions work offline |

| Cloud Hosting | ✅ Yes | 100% cloud-based SaaS, no local installation needed |

Pricing (2025)

| Plan | Monthly Cost | Key Features | Ideal For |

|---|---|---|---|

| Simple Start | $30 | Invoicing, expense tracking, reports | Freelancers, solopreneurs |

| Essentials | $60 | Adds time tracking, multi-user access | Service providers, consultants |

| Plus | $90 | Project profitability, inventory tracking | SMBs with inventory or multiple projects |

| Advanced | $200 | Invoicing, expense tracking, and reports | Larger teams, growing businesses |

| Payroll Add-On | From $45/mo | Full-service payroll, tax filing, employee tools | Employers with W-2 or 1099 staff |

- Free Trial: 30 days

- No Free Plan, but frequent 50% off for 3 months

Pros and Cons

Pros:

- ✅ Deep accounting features yet simple enough for non-experts

- ✅ Excellent mobile app with strong on-the-go capabilities

- ✅ Scalable pricing plans to suit business growth

- ✅ Seamless syncing with banks and third-party apps

- ✅ Smart reporting and automation powered by AI

Cons:

- ❌ Higher-tier plans can be costly, especially with add-ons

- ❌ Limited offline access for cloud-based users

- ❌ Customer support can be inconsistent

- ❌ Learning curve for some features like journal entries

Customer Support and Resources

- Support Channels: Live chat, phone support, AI chat, help center

- Availability: Monday to Friday, extended business hours

- Help Center: Articles, FAQs, video tutorials, webinars

- ProAdvisor Network: Hire certified accountants directly

- Community Forum: Peer-to-peer troubleshooting and feature requests

While most users find the documentation thorough, some have noted longer wait times on live support channels, especially during tax season.

Real-World Use Cases / Ideal Users

Freelancers & Creators

A freelance writer uses QuickBooks Online to track invoices for brand clients, auto-categorize business expenses, and prep Schedule C forms with minimal help.

E-Commerce & Retail

An online store owner integrates Shopify with QuickBooks to track inventory in real time, manage supplier payments, and generate weekly sales reports.

Small Business Teams

A construction firm uses the Plus plan to track time per project, assign billable hours, and generate profitability reports for client bidding.

Accountants & Bookkeepers

QuickBooks lets accountants manage multiple client accounts in a centralized dashboard, saving time with automation, batch invoicing, and reconciliation tools.

User Reviews and Ratings

| Platform | Rating | Highlights |

|---|---|---|

| G2 | 4.0/5 | Powerful tools, some UI quirks |

| Capterra | 4.3/5 | Strong automation, excellent invoicing |

| Trustpilot | 2.5/5 | Mixed customer service experiences |

| Software Advice | 4.2/5 | Well-liked by SMBs and freelancers |

“QuickBooks Online streamlined our invoicing and reporting—now I spend 70% less time on admin.”

– Luis G., Agency Owner (via Capterra)

Best Alternatives to QuickBooks Online

| Tool | Best For | Notable Advantage |

|---|---|---|

| Xero | Multi-currency, unlimited users | Great for international businesses |

| FreshBooks | Solopreneurs, consultants | Simplified UI with built-in time tracking |

| Wave Accounting | Budget-conscious entrepreneurs | Free core tools but fewer integrations |

| Zoho Books | Zoho ecosystem users | Full automation when paired with Zoho apps |

| Sage Business Cloud | Mid-sized teams | Strong payroll and audit features |

Each alternative has its niche strengths but may lack QuickBooks’ depth or ecosystem.

Summary

QuickBooks Online remains the gold standard for small business accounting software in 2025. It blends powerful features—like smart invoicing, automation, and real-time reporting—with an approachable design that works for both financial professionals and business owners without an accounting background.

Its scalability, mobile functionality, and deep integration ecosystem make it a strong investment for freelancers, startups, and growing SMBs. While the pricing may rise with added features and services, the time saved and insights gained often justify the cost.

For anyone serious about taking control of their finances in a modern, cloud-powered environment, QuickBooks Online is well worth considering.

Explore more on the official QuickBooks Online website or compare it with other top tools on usefully.site.

Media

How to use QUICKBOOKS ONLINE (2025)

How to Use QuickBooks Online 2025

QuickBooks Online 2025 Tutorial for Beginners (Even If You Hate Tracking Expenses!)